Money is one of the most significant factors influencing relationships and partnerships. It can be a source of stress or conflict, but when managed well, it can also help foster a stronger bond. Discussing finances openly, understanding each other’s money habits, and aligning on financial goals are essential components of any healthy relationship. In this article, we explore how money plays a critical role in romantic relationships, provide advice on making smart financial decisions as a couple, and address challenges that may arise due to differing financial circumstances or mindsets.

The Importance of Open Communication About Finances

One of the foundational elements of a successful relationship is communication, and this includes discussing finances. Open and honest communication about money can reduce misunderstandings and build trust between partners. Without transparency, financial secrets or misconceptions can fester and create tension or resentment. By fostering an environment where both partners feel comfortable discussing their financial goals, fears, and expectations, they can develop a shared understanding of how money should be managed.

Discussing finances early in a relationship is particularly important when setting expectations about spending habits, saving goals, and how financial decisions will be made. This also includes talking about debt, income, and long-term goals. Many couples avoid discussing money due to fear of conflict or awkwardness, but delaying these conversations can result in bigger problems down the road. When partners communicate clearly and openly about finances, it becomes easier to align their strategies and work toward common goals.

Establishing Joint Financial Goals

Setting financial goals as a couple is a crucial step toward achieving long-term financial stability and success. Joint financial goals not only help partners build a future together but also promote teamwork and mutual support. These goals could range from saving for a home, paying off debt, funding a child’s education, or planning for retirement. By working toward shared objectives, couples are better able to prioritize their finances and stay focused on what is important to both individuals.

When setting joint financial goals, it is important to ensure that both partners’ aspirations and needs are considered. One partner may have a strong desire to travel, while the other may prioritize homeownership. It is essential to discuss these different priorities and find ways to merge them into a unified financial plan. Both partners should feel heard and valued in these discussions, as this will contribute to a sense of mutual respect and understanding in the relationship.

In addition, couples should set clear timelines for achieving their financial goals and revisit them regularly to track progress. This could involve creating a joint budget, determining how much of each partner’s income will be allocated toward specific goals, and making adjustments as life circumstances change. Regular check-ins ensure that both partners are on the same page and prevent the goals from becoming neglected or lost amidst daily life.

Understanding Each Other’s Financial Habits and Mindsets

Financial compatibility is essential for a harmonious partnership. Each person brings their own financial habits and mindset to a relationship, which can either complement or conflict with their partner’s approach to money. Understanding these differences can help couples navigate potential challenges and create strategies for managing their finances together.

Financial habits often stem from upbringing and personal experiences. One partner may have grown up in a household that prioritized saving, while the other might have been taught to spend freely. Recognizing and understanding these differences can help prevent judgment or frustration. It’s important to approach these differences with empathy and work together to find common ground.

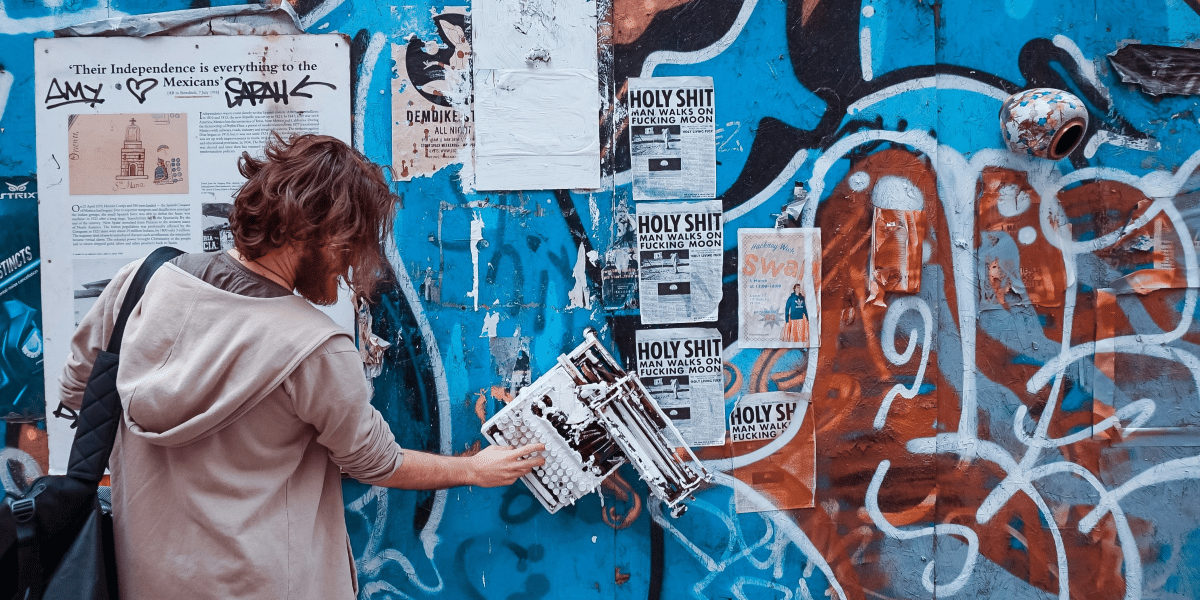

Photo Credit: Unsplash.com

A critical aspect of understanding each other’s financial habits is acknowledging any potential financial baggage. This includes addressing issues such as debt, credit scores, and past financial mistakes. Open conversations about these topics can help reduce the anxiety that comes with financial disagreements and set the stage for rebuilding a strong financial foundation together.

In relationships where there is a significant disparity in income levels, it’s crucial to have open discussions about how money will be shared and managed. Unequal income can sometimes lead to imbalances in responsibility or resentment if not addressed. It’s important for both partners to feel that their contributions—whether financial or non-financial—are valued and that the financial structure of the relationship is fair and transparent.

Navigating the Challenges of Unequal Income and Different Money Mindsets

In many relationships, partners have differing income levels, which can lead to complications in how expenses are divided and how financial goals are approached. One partner may have a higher income, while the other may have a lower-paying job, or they may be in different stages of their careers. This income gap can create tension, particularly if one partner feels they are contributing more financially or if they worry about the financial burden on the other.

To navigate this challenge, couples should have an open discussion about how to divide expenses in a way that feels equitable. This doesn’t necessarily mean splitting everything 50/50. Instead, it may involve adjusting contributions based on income. For example, the higher-earning partner might contribute a larger share of household expenses, while the lower-earning partner takes on other responsibilities, such as managing the household or non-financial contributions. The key is to find a balance that feels fair to both partners.

Another challenge that can arise in relationships is differing money mindsets. One partner may be risk-averse, preferring to save and avoid debt, while the other might be more comfortable with spending and taking financial risks. These differing approaches can lead to tension if not properly managed. It’s important for partners to have an honest discussion about their financial philosophies and agree on a strategy that works for both of them. This might involve compromise, such as setting limits on discretionary spending or creating separate accounts for personal spending while maintaining a joint account for shared expenses.

Building Financial Harmony as a Couple

Understanding and respecting each other’s financial perspectives is crucial for maintaining harmony in the relationship. Couples should approach money management as a partnership, where both individuals contribute to decisions in a way that respects their values and financial priorities.

Money plays a significant role in relationships, and navigating financial matters with your partner requires open communication, shared goals, and a deep understanding of each other’s financial habits and mindsets. By discussing finances early and setting joint financial goals, couples can work together to build a secure future. Understanding and managing differing income levels or financial philosophies is essential for avoiding tension and ensuring that both partners feel respected and valued. Ultimately, approaching finances as a team helps create a strong foundation for a healthy, financially stable relationship.