The Initial Public Offering (IPO) is a transformative event for any business, often seen as the ultimate milestone in a company’s growth. It provides access to capital, increased visibility, and the opportunity for founders to realize the full value of their efforts. For BIPOC entrepreneurs, the journey to an IPO represents more than just financial success—it’s a victory over systemic barriers and an opportunity to inspire the next generation of diverse business leaders.

In recent years, a number of BIPOC entrepreneurs have risen to prominence for taking their companies public or positioning them to do so. These leaders are not only changing the face of entrepreneurship but are also setting new standards for diversity in the public markets.

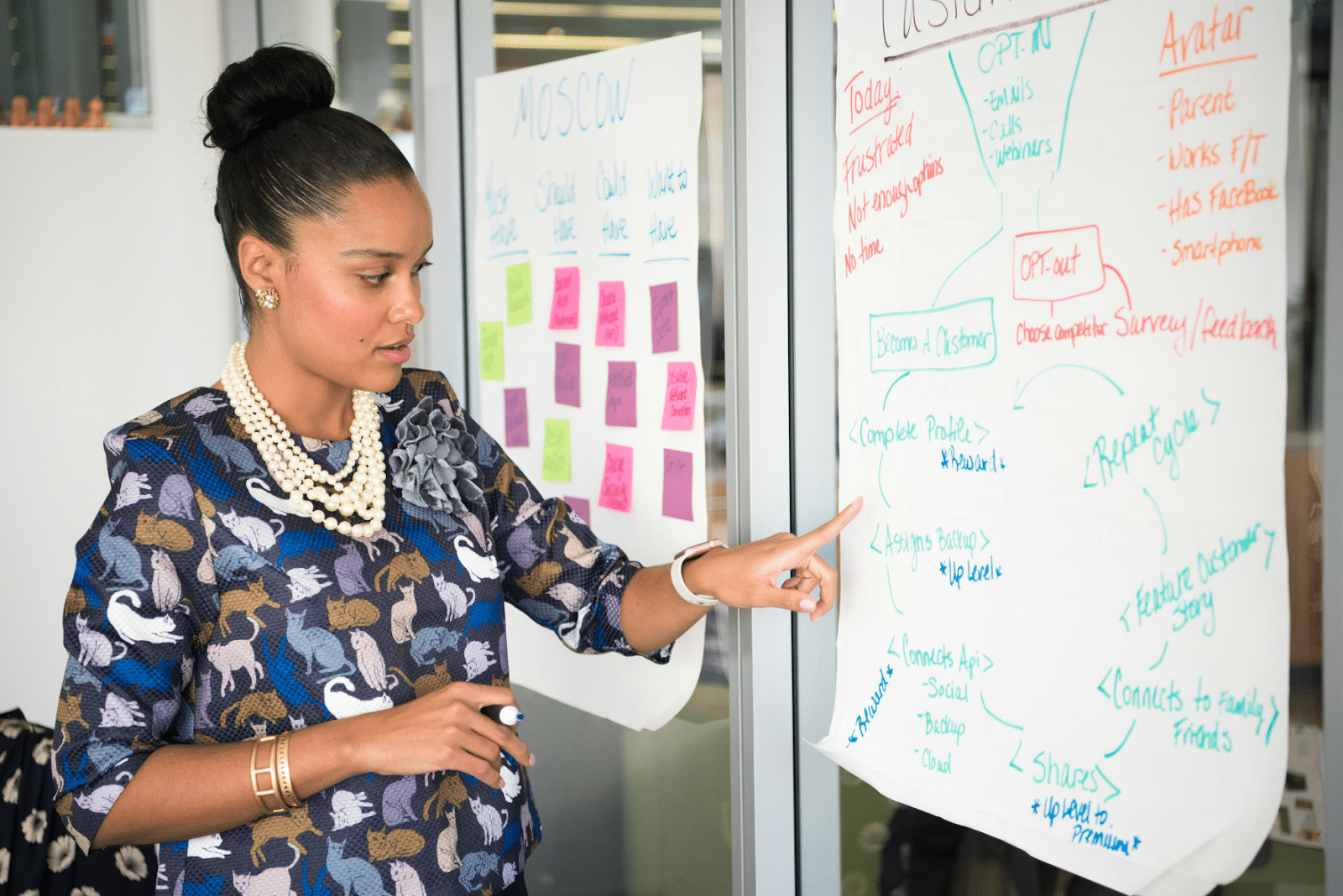

Photo: Unsplash.com

Breaking into the IPO World: The Rise of BIPOC Entrepreneurs

For many BIPOC entrepreneurs, the path to going public is fraught with challenges, from limited access to venture capital to systemic biases that have historically excluded them from the highest echelons of business. However, recent trends show a shift, with more BIPOC-led companies entering the public markets.

Ruben Harris, co-founder and CEO of Career Karma, is one such entrepreneur. His company, which connects job seekers with training programs to break into tech, has grown significantly, with a valuation that places it in line for a potential IPO. Harris’s leadership and vision have turned Career Karma into a platform that empowers diverse talent to enter high-paying industries, all while positioning the company for a public debut in the future.

Another leader to watch is Melissa Butler, founder and CEO of The Lip Bar, a vegan, cruelty-free beauty brand. After securing a deal on Shark Tank, Butler scaled her company significantly, expanding its product offerings and increasing its retail presence in major stores like Target. Butler’s journey from bootstrapping her business to national retail success is a powerful example of the potential for BIPOC entrepreneurs to achieve IPO-level growth.

The Financial Landscape: Barriers and Opportunities

While these success stories are encouraging, the financial landscape remains a difficult one for many BIPOC entrepreneurs. Venture capital funding for BIPOC founders remains disproportionately low, with only a small fraction of funding going to businesses led by Black, Latino, and Indigenous entrepreneurs. Without the necessary capital to grow, it can be difficult to scale a business to the point where an IPO is possible.

Despite this, some BIPOC-led companies have found success by looking beyond traditional venture capital routes. Community-driven financing models, strategic partnerships, and leveraging new financial technologies such as crowdfunding platforms have become viable alternatives for raising capital. These models allow BIPOC entrepreneurs to maintain greater control over their companies while positioning them for long-term growth.

One example of this is Tristan Walker, founder of Walker & Company, a health and beauty company designed specifically for people of color. After raising millions in venture capital and scaling his business, Walker eventually sold his company to Procter & Gamble, setting the stage for future IPO considerations. His strategic decision to partner with a global giant highlights how acquisitions and mergers can also provide pathways for BIPOC entrepreneurs to access the capital needed for public listings.

Photo: Unsplash.com

Steps to IPO Success for BIPOC Entrepreneurs

For BIPOC entrepreneurs considering an IPO, preparation is key. Here are some critical steps that can help ensure success:

- Build a Strong Financial Foundation: Before going public, ensure that your company’s financials are solid and that you have a clear growth trajectory. Investors will want to see not only revenue growth but also profitability or a clear plan to reach it.

- Create Strategic Partnerships: Partnerships with larger firms or key players in your industry can help accelerate growth and credibility. For example, securing a strategic partnership with a major corporation can provide the resources and backing needed to scale quickly.

- Leverage Networks: Networking and mentorship are invaluable when preparing for an IPO. BIPOC entrepreneurs should connect with other leaders who have successfully taken their companies public and learn from their experiences. Organizations like BLCK VC and The Latino Coalition offer mentorship and resources to support BIPOC entrepreneurs in scaling their businesses.

- Understand Regulatory Requirements: Navigating the regulatory landscape is a crucial part of the IPO process. Understanding SEC requirements, filing forms like the S-1 registration statement, and ensuring compliance with financial reporting standards are essential steps.

The Long-Term Impact of BIPOC-Led IPOs

The success of BIPOC entrepreneurs in taking their companies public has far-reaching implications. Not only do these entrepreneurs set a precedent for future generations, but they also contribute to a more inclusive economy. When diverse businesses succeed, they create jobs, foster innovation, and promote wealth-building within historically marginalized communities.

BIPOC-led companies also tend to prioritize diversity in their hiring and operational practices, creating opportunities for underrepresented talent to succeed in industries where they have traditionally been excluded. This commitment to inclusion strengthens not only the individual company but also the broader market, driving competition, innovation, and equitable growth.

Photo: Unsplash.com

Conclusion

BIPOC entrepreneurs are making their mark on the IPO landscape, and their influence will only continue to grow. From Ruben Harris at Career Karma to Melissa Butler at The Lip Bar, these leaders are not just transforming industries but are also creating pathways for future generations of BIPOC business leaders. As more diverse companies prepare for IPOs, the business world will continue to evolve, becoming more inclusive, equitable, and reflective of the diverse talent that drives innovation and success.

Published by: Nelly Chavez